01 Jul When Should you Review your Estate Plan?

...

15 Mar Estate Planning for Retirees

...

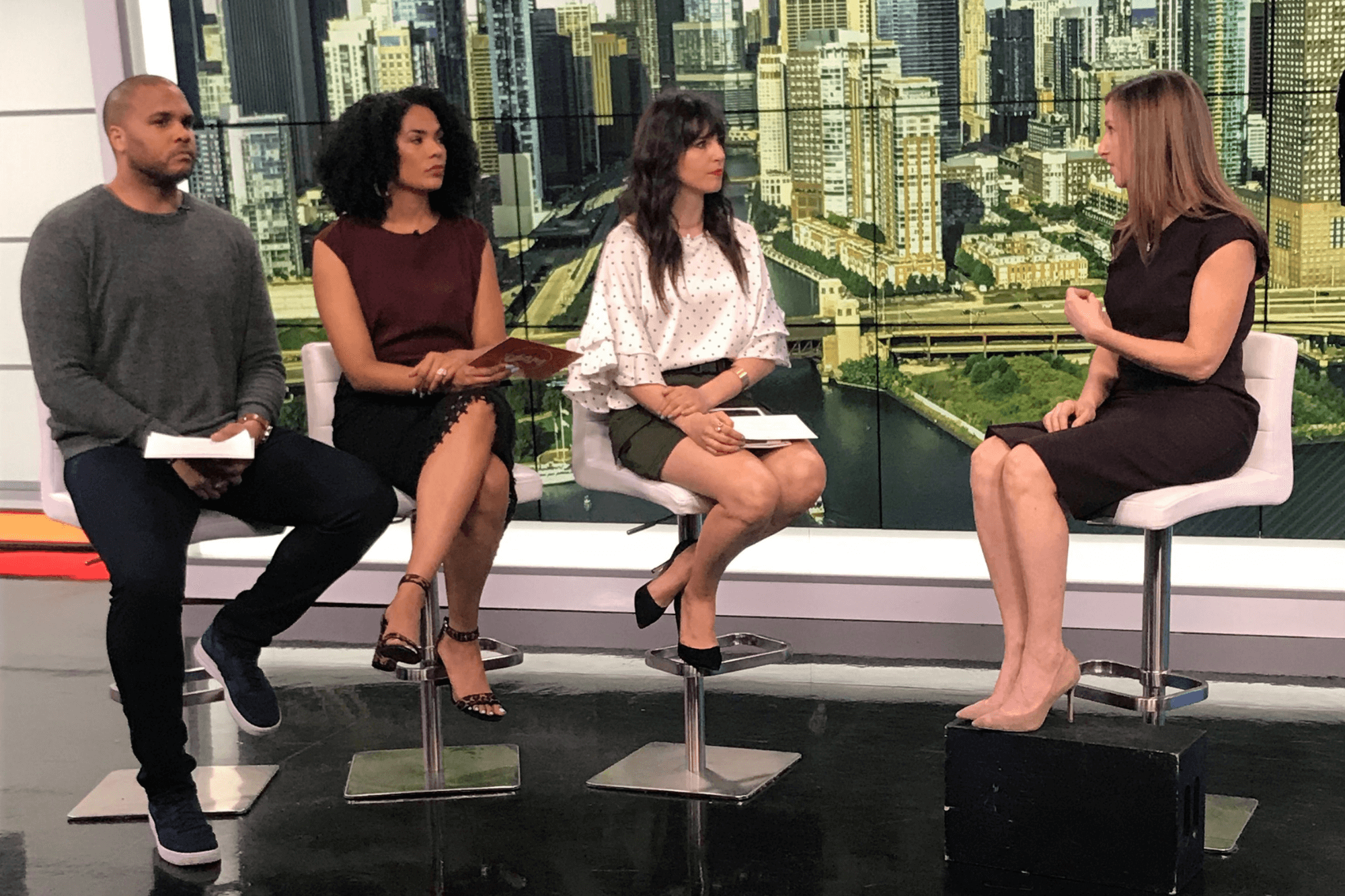

13 Mar Jennifer Guimond-Quigley Discusses Pet Inheritance CBS Money Watch

CBS Money Watch reached out to Jennifer to discuss Karl Lagerfeld's inheritance to his beloved cat, Choupette. See what Jennifer had to say on how much a pet can actually receive when their owner passes. ...

13 Mar Bankrate Features Jennifer Guimond-Quigley

...

01 Mar Estate Planning for New Parents

...

25 Feb Estate Planning Triggers

...

19 Feb How to Be In Business With Your Spouse

...